*Please note, these are general instructions to fill out your form. We advise you to speak with a tax consultant to ensure accuracy on your W-9 (or W-8).

Name (Lines 1 and 2)

Put your name or business name exactly as you file your taxes. If you are paid and file taxes under your business’ name, please put it exactly as it is on your tax return. For example:

Federal Tax Classification (Line 3)

Check the appropriate box in line 3 for the U.S. federal tax classification

The “individual/sole proprietor or single-member LLC” box is the appropriate box to check for:

The “limited liability company” box is the appropriate box to check for:

Part I – Taxpayer Identification Number (TIN)

Here, you’ll have two boxes for Social Security Number (SSN) and Employer Identification Number (EIN). You only need to fill out one of them:

Part II – Certification

For LLCs, please review the following scenarios with examples as we receive many forms that aren’t completed correctly.

LLC Scenario Example

Information to be used for the examples:

Name of beneficial owner of LLC: John Smith (an individual)

SSN for John Smith: 123-45-6789

EIN for John Smith: 98-7654321

Name of LLC: JSmith, LLC

EIN for JSmith, LLC 12-9876543

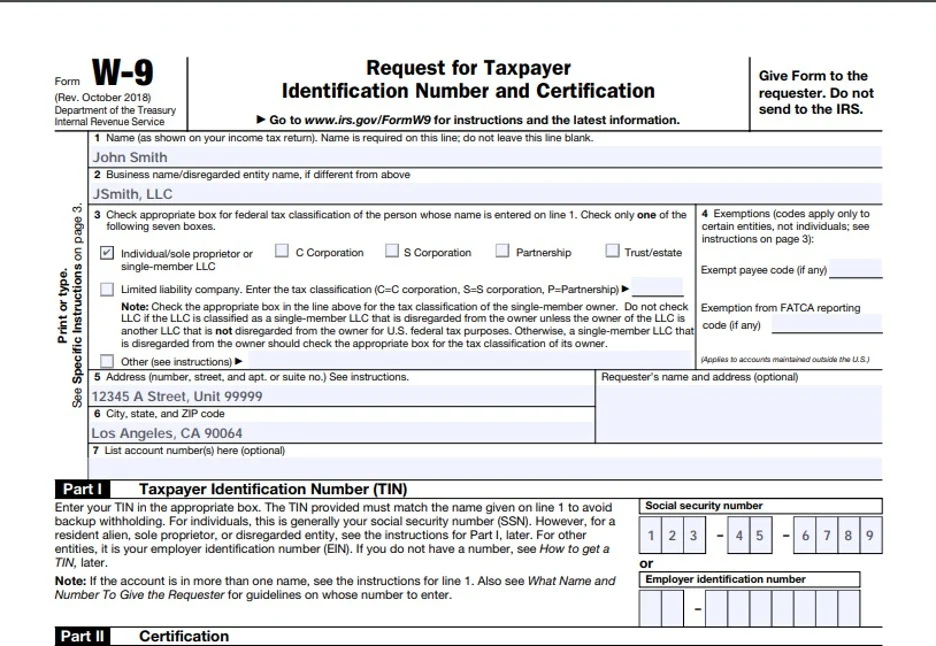

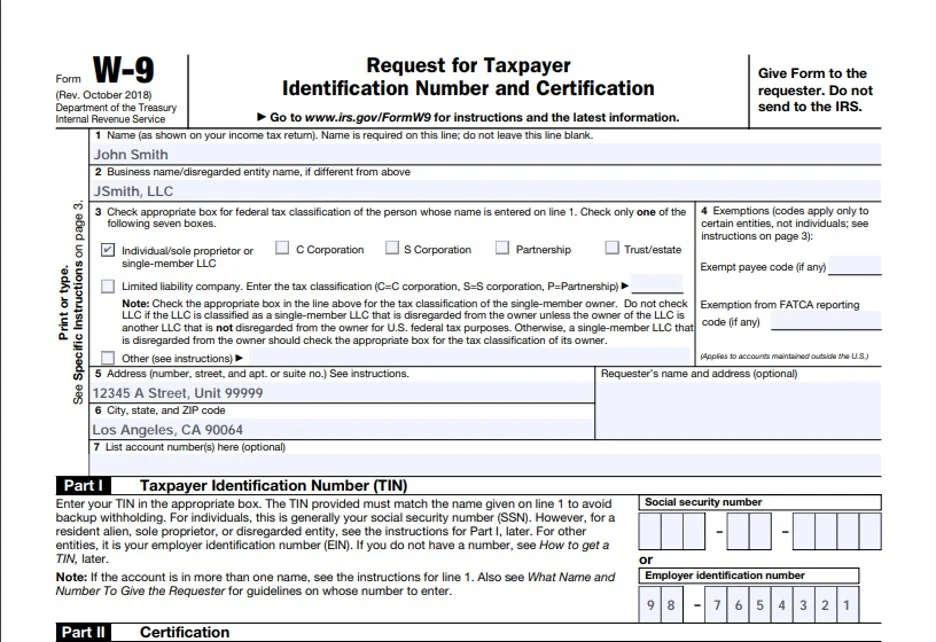

SCENARIO 1:

JSmith, LLC is a single-member LLC owned by John Smith. John Smith did NOT make an election with the IRS to treat the LLC as a corporation. The LLC’s income is reported on John Smith’s individual tax return.

John Smith’s SSN should be provided. If John Smith applied for and received an EIN from the IRS, his EIN can be used instead of his SSN. The LLC’s EIN should NOT be used.

OR

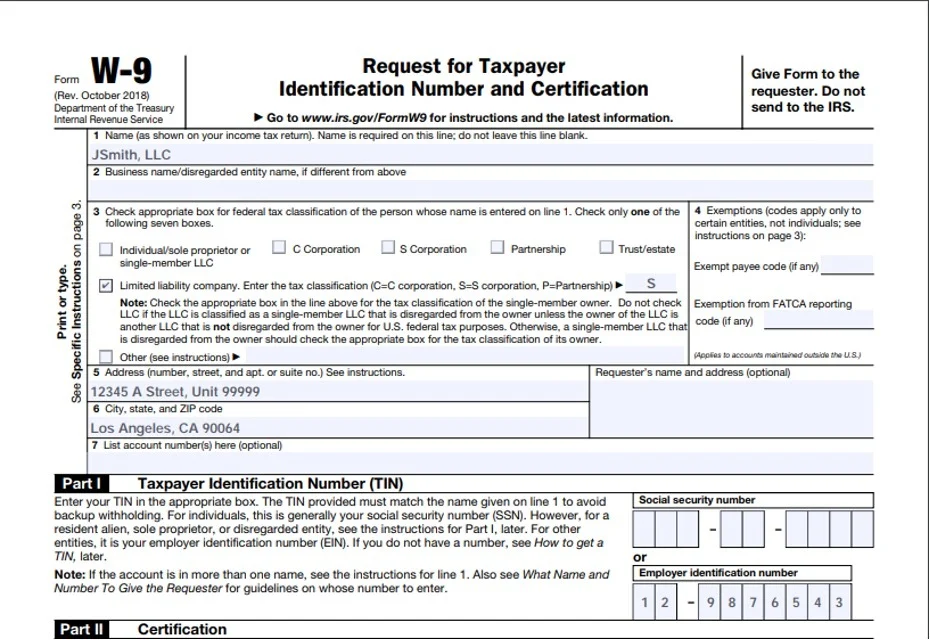

SCENARIO 2:

JSmith, LLC is a single-member LLC owned by John Smith. John Smith made an election with the IRS to treat the LLC as an S corporation. The LLC files taxes separate from John Smith.

©2025 ShopYourLikes